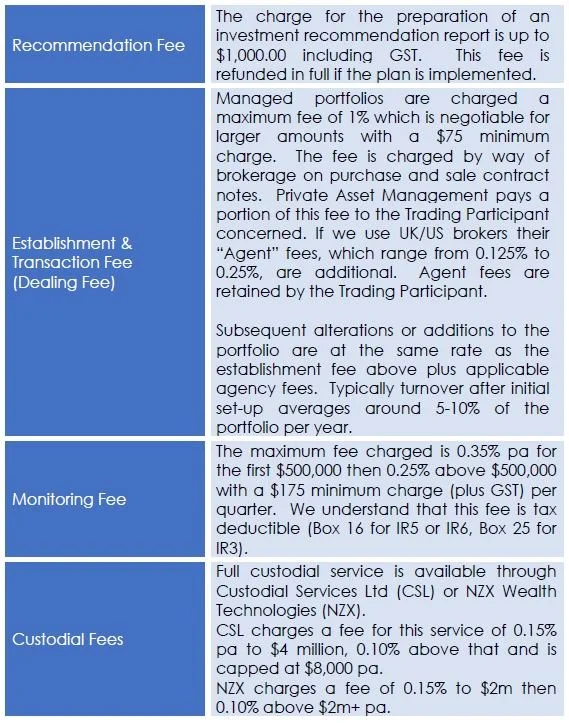

What does it cost?

We are fee based advisers which means we charge a flat transaction fee – usually 0.8% to 1.0% of the sum invested to implement a portfolio recommendation. We pay the stockbrokers whom we use to execute transactions from this fee. If we also use UK/US brokers their fee, which ranges from around 0.125% to 0.25%, is additional. Most of our clients have sums to invest in excess of $500,000 and the implementation fee at this level is 0.8% and over that is negotiable.

To manage the portfolio, report to you quarterly, and provide weekly research etc we charge a 0.35% fee per annum reducing to 0.25% for amounts over $500,000 with a minimum charge of $175 plus GST per quarter. Most of our competitors charge annual fees of 3x this level.

We are genuinely independent and are fee based advisers, so our recommendations to clients are completely free of any bias. The products we use pay no commission and none pay any trailing fees. We don’t flog “new issues” or junk bonds to clients just because they pay high commission. We don’t have a “corporate” department with loyalties to companies for whom we act. We don’t have any institutional clients. If fund managers charge high fees or generally act the goat we are not afraid to say so. We answer to our clients only. We are genuinely independent.

Our Standard Fee Schedule is below: